Term Or Life Insurance

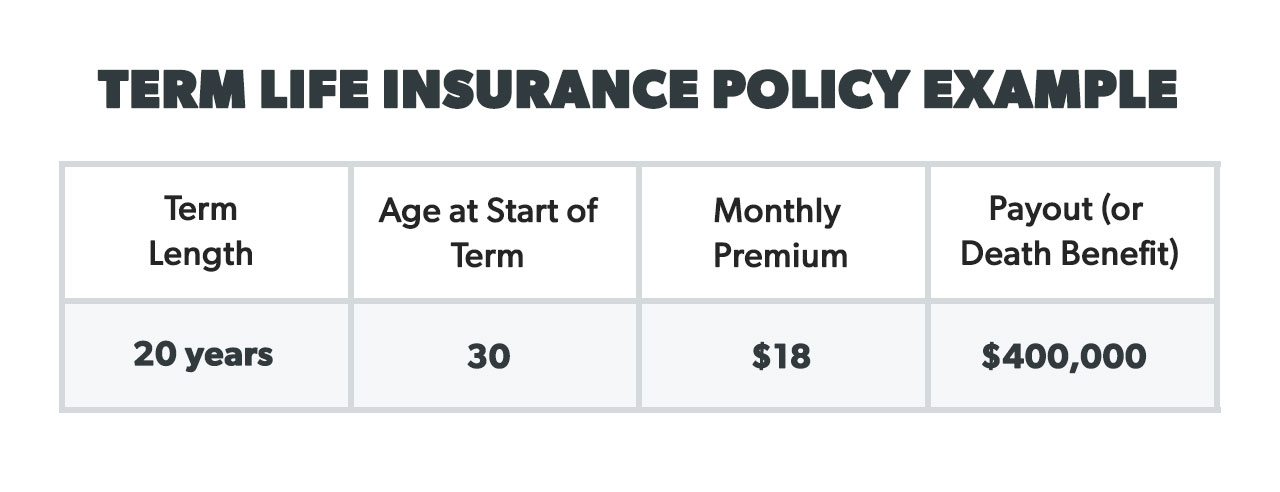

Term life insurance is purchased for a specific period of time usually from one to twenty years. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

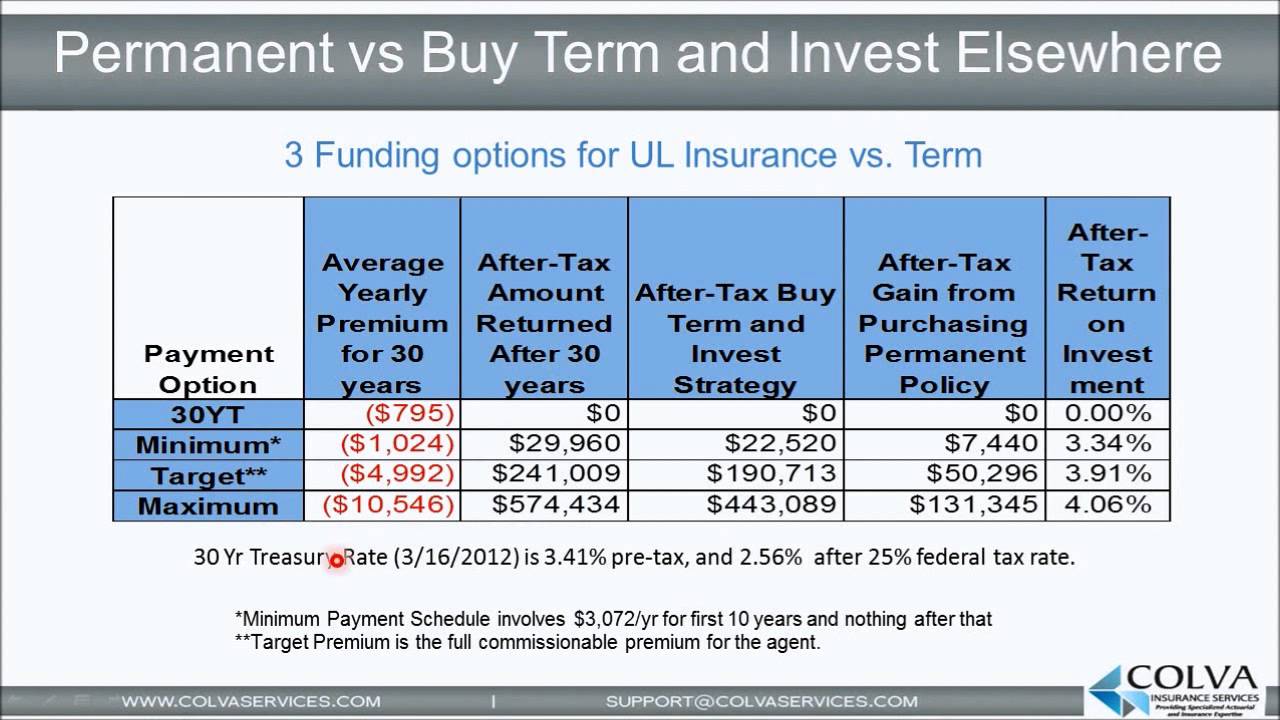

Permanent Life Insurance Vs Buy Term And Invest Strategy Life

Permanent Life Insurance Vs Buy Term And Invest Strategy Life

For example if your liabilities or your income increases during a particular life stage.

Term or life insurance. Because you may not need that financial protection anymore and you dont want to pay for an unnecessary insurance policy. Term life policies have no value other than the guaranteed death benefit. There is no savings component as found in a whole life insurance product.

Term insurance is initially much less expensive when compared to permanent life insuranceunlike most types of permanent insurance term insurance has no cash value. Compare cost and policy features. A term life insurance policy doesnt offer any of these benefits.

Term life insurance is cheap because its temporary and has no cash value. Term life insurance lasts for a set number of years the term before it expires and youre no longer covered. The policys purpose is to give insurance to.

If you or your spouse passes away at any time during this term usually 2030 years your beneficiaries those youve selected to inherit your money will receive a payout from the term life insurance policy. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Because of the added living benefits whole life insurance typically carries a higher price tag compared to term life insurance.

Term life insurance and permanent life insurance serve important purposes but theyre intended for different needs. Whole life insurance costs more because it lasts a lifetime and does have cash value. Depending on your insurance policy and provider you may even receive dividends that you can use to pay premiums increase cash value or receive as cash.

You are confident that you are able to earn a higher return than the bonuses that the insurer offers you. Term life insurance provides life insurance coverage for a specific amount of time. Its the age old question when it comes time to buying life insurance.

When should you take up term life. Here are ways to assess which one is right for you. In other words the only value.

At the end of the term you receive no return on the money that you paid for the insurance but if you die before the term is over then your loved ones will receive the full amount of the policy. Why do you want a life insurance policy that runs out. However you can purchase term insurance to complement your whole life insurance.

Term Life Or Whole Life Which Insurance Is Best For You

Term Life Or Whole Life Which Insurance Is Best For You

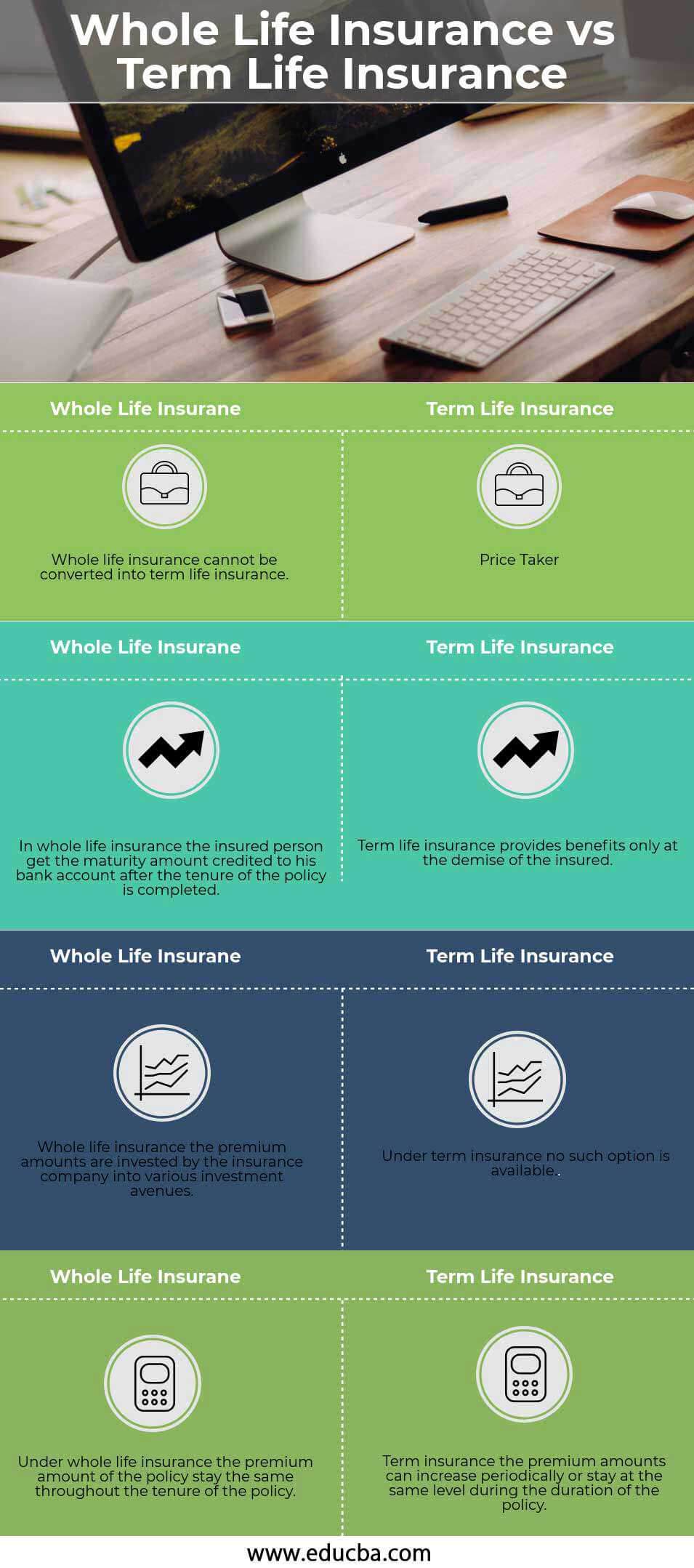

Infographic Whole Life Insurance Vs Term Life Insurance Symbo

Infographic Whole Life Insurance Vs Term Life Insurance Symbo

Whole Life Insurance Vs Term Life Insurance Top 4 Amazing

Whole Life Insurance Vs Term Life Insurance Top 4 Amazing

Term Life Vs Universal Life Insurance

Term Life Vs Universal Life Insurance

Term Vs Whole Life Insurance My Cheap Term Life Insurance

Term Vs Whole Life Insurance My Cheap Term Life Insurance

Best Term Life Insurance For Seniors Rates Secrets Revealed Buy

Best Term Life Insurance For Seniors Rates Secrets Revealed Buy

Should You Buy Mortgage Protection Or Term Life Insurance Good

Should You Buy Mortgage Protection Or Term Life Insurance Good

Should I Buy Term Or Whole Life Insurance

Should I Buy Term Or Whole Life Insurance

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Which Is Better Term Or Whole Life Insurance In Your 30s Quotacy

Which Is Better Term Or Whole Life Insurance In Your 30s Quotacy

Mylifeinsuranceforelderly Com Which Is Better Term Or Whole Life Insu

Mylifeinsuranceforelderly Com Which Is Better Term Or Whole Life Insu

Term Vs Permanent Life Insurance Educational Infographic

Term Vs Permanent Life Insurance Educational Infographic

Mortgage Term Life Insurance Quote Thenestofbooksreview

Mortgage Term Life Insurance Quote Thenestofbooksreview

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

Life Insurance Comparison Term Or Whole Life Text Vector Image

Life Insurance Comparison Term Or Whole Life Text Vector Image

Term Life Vs Permanent Life Insurance Trovato Associates

Term Life Vs Permanent Life Insurance Trovato Associates

How To Leave An Inheritance With Life Insurance

How To Leave An Inheritance With Life Insurance

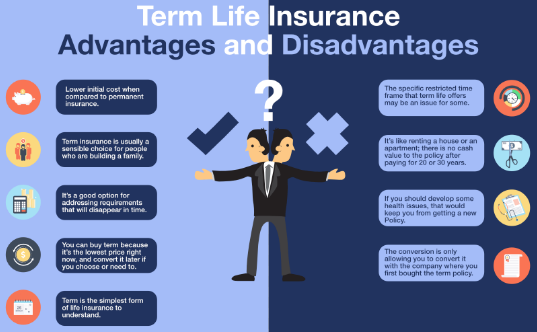

How Term Life Insurance Works Pros And Cons Comparison

How Term Life Insurance Works Pros And Cons Comparison

Which Makes Sense For You Permanent Or Term Life Insurance

Which Makes Sense For You Permanent Or Term Life Insurance

Term Life Insurance For Newlyweds Text Background Vector Image

Term Life Insurance For Newlyweds Text Background Vector Image

Liberty Financial Group Term Life Insurance Or Permanent Life

Liberty Financial Group Term Life Insurance Or Permanent Life

Komentar

Posting Komentar