Term Vs Whole Life Insurance Comparison

Aside from the policy features the biggest difference between term and whole life insurance policies is the cost. Youre sure to encounter different and confusing policies and phrases such as whole life term life cash value and variable life.

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

We want to set the record straight.

Term vs whole life insurance comparison. When youre thinking about your familys finances ensuring that your income is protected now and in the future is important. There is a lot of misinformation and half truths out there when it comes to comparing whole life against term life insurance. This is because the term life policy has no cash value until you or your spouse passes away.

A term life insurance policy has 3 main components face amo. Life insurance provides important financial benefits but navigating the landscape of its terms and implications can be tricky. Whole life vs term a comparison august 1 2017.

In the simplest of terms its not worth anything unless one of you were to die during the course of the term. Term and whole life are the most common typesand each has its benefits. Due to the lifetime coverage and cash value whole life insurance costs considerably more meaning it can easily come to 10 times the cost of a term policy with the same death benefit.

Now that you know the differences between term life insurance and whole life insurance you can make an informed choice to find the best life insurance solution for you and your family. Find out more by contacting an insurance agent in your area. Life insurance can help you do that.

When analyzing term vs whole life insurance youll want to look at several different factors. Whole life insurance calculator. In most cases your family wont receive a payout because youll live to the.

Well cover how to calculate the differences between term and whole life insurance and help you decide which option is best for your needs. The main difference between term life insurance and whole life insurance is that term life insurance serves as insurance only whereas whole life insurance is actually insurance plus investment. Many people decide that a combination works best.

Term life insurance vs whole life insurance comparison. Term life insurance plans are much more affordable than whole life insurance. Term life insurance is cheap because its temporary and has no cash value.

Term life is typically better for people who want affordable coverage in the unlikely event of their earlier than expected death especially during a critical time in life such as parenting young children or taking on a larger mortgage. Whole life term life.

Whole Life Insurance How It Works

Whole Life Insurance How It Works

Compare Life Insurance Options Term Vs Whole Life

Compare Life Insurance Options Term Vs Whole Life

Term Life Insurance Vs Whole Life Insurance Johnson

Term Life Insurance Vs Whole Life Insurance Johnson

Whole Life Insurance Comparison Chart Parta Innovations2019 Org

Whole Life Insurance Comparison Chart Parta Innovations2019 Org

How To Compare Buy Life Insurance Policygenius

How To Compare Buy Life Insurance Policygenius

Compare Term Vs Whole Life Insurance Policy

Compare Term Vs Whole Life Insurance Policy

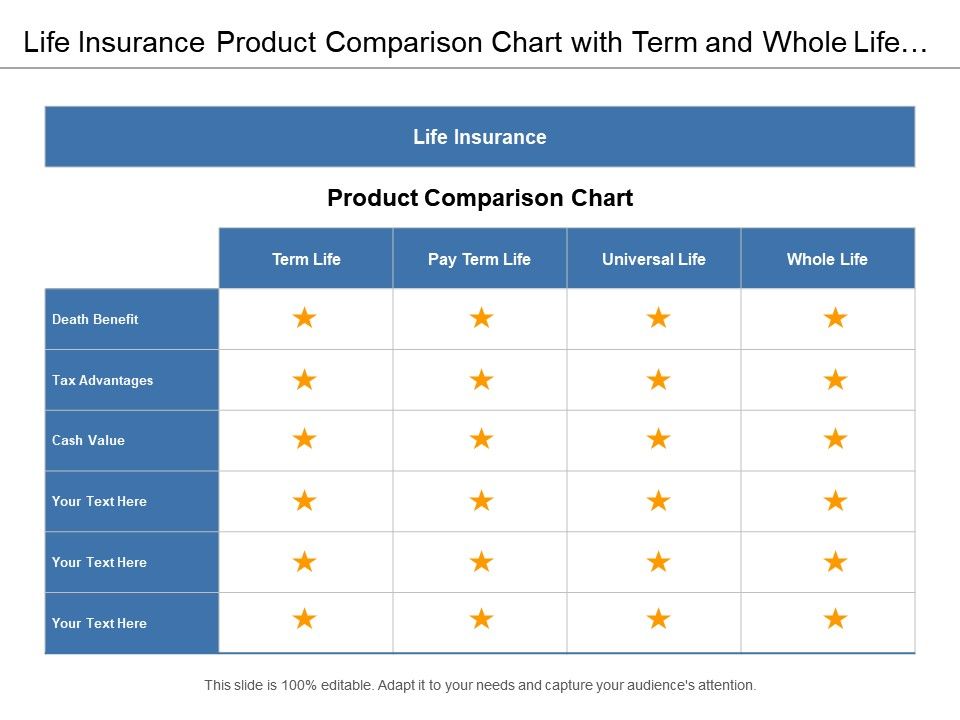

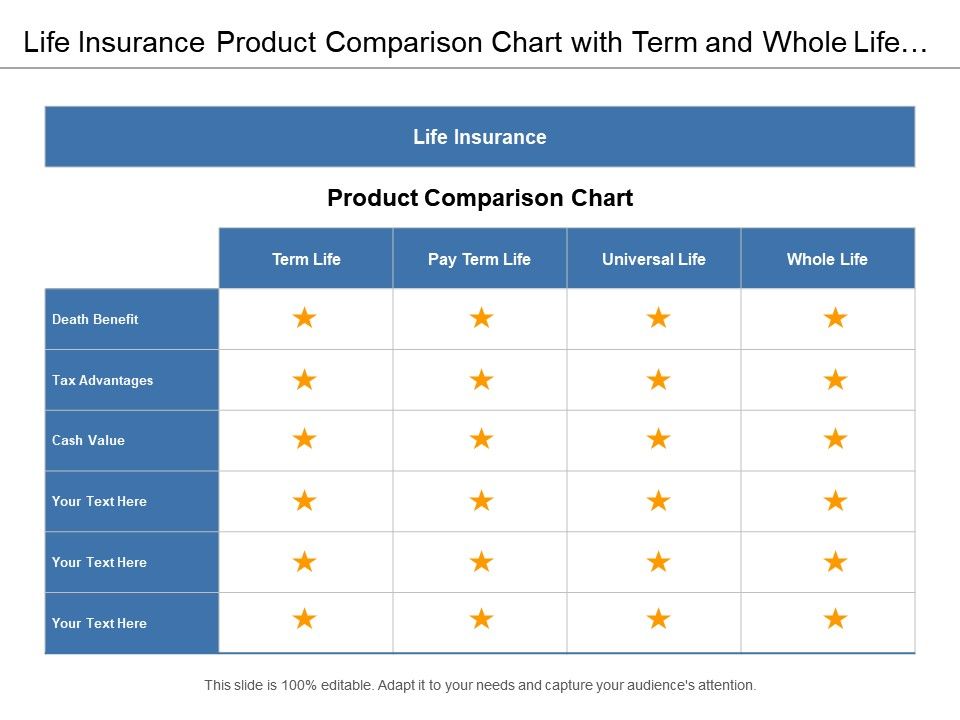

Life Insurance Product Comparison Chart With Term And Whole Life

Life Insurance Product Comparison Chart With Term And Whole Life

Here Is Comparison Between Term Life Insurance And Permanent Life

Here Is Comparison Between Term Life Insurance And Permanent Life

Term Vs Whole Life Insurance Youtube

Term Vs Whole Life Insurance Youtube

Types Of Life Insurance Chart Parta Innovations2019 Org

Types Of Life Insurance Chart Parta Innovations2019 Org

Best Whole Life Insurance Of 2019 Cash Value Prices Much More

Best Whole Life Insurance Of 2019 Cash Value Prices Much More

Term Vs Whole Life Insurance Which Type Is Best For You Safe

Term Vs Whole Life Insurance Which Type Is Best For You Safe

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

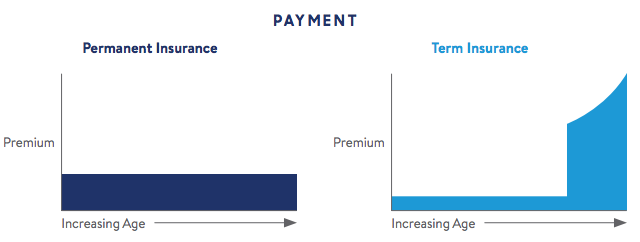

Term Vs Permanent Insurance What S The Difference Western

Term Vs Permanent Insurance What S The Difference Western

Compare Life Insurance Options Term Vs Whole Life

Compare Life Insurance Options Term Vs Whole Life

Guide To Purchasing Life Insurance

Guide To Purchasing Life Insurance

An Easy To Understand Comparison Between Term Life And Whole Life

An Easy To Understand Comparison Between Term Life And Whole Life

How To Leave An Inheritance With Life Insurance

How To Leave An Inheritance With Life Insurance

Comparing Term Life Insurance Whole Life Insurance

Comparing Term Life Insurance Whole Life Insurance

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Life Insurance Comparison Term Vs Universal Vs Whole Life Insurance

Life Insurance Comparison Term Vs Universal Vs Whole Life Insurance

Term Vs Permanent Compelling Reasons For Permanent Insurance

Term Vs Permanent Compelling Reasons For Permanent Insurance

Komentar

Posting Komentar