Split Life Insurance

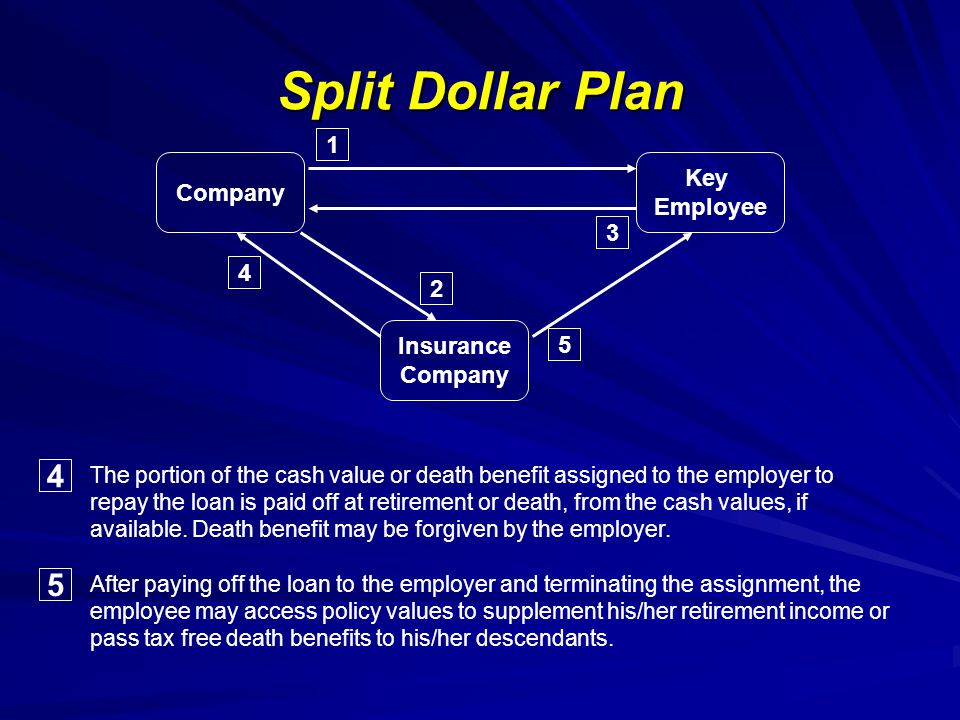

In a split dollar plan an employer and employee execute a written agreement that outlines how they will share the premium cost cash value and death benefit of a permanent life insurance policy. In this type of insurance the premium amount paid determines the amount of insurance the annuitant can purchase.

Gains Drawbacks Of Split Dollar Life Insurance Tipsever

Gains Drawbacks Of Split Dollar Life Insurance Tipsever

Split life insurance if you are looking for quotes on different types of insurance then our service can help you find what you are looking for.

Split life insurance. They have mutual benefits for employees and employers. Split life insurance if you are looking for quotes on different types of insurance then we can give you insurance quotes that will help you find what you are looking for. Insurance that is partially an installment annuity and partially term insurance.

So understanding the wonky terminology commonly used for beneficiary designations is. This type of life insurance is generally used for businesses to help an employee purchase coverage it can be used as a form of deferred compensation or as an incentive for the employee to work at that company. Split dollar life insurance is an arrangement between an employer and an employee to share the costs and benefits of a life insurance policy.

Split life insurance is a life insurance policy that is purchased by two or more parties. Common provisions covered in a split dollar plan are who pays the policy premiums and how the benefits are paid or shared. I believe what you are referring to is whats called split dollar life insurance.

Plans can be used with survivorship life insurance permanent life and whole life insurance policies that have cash values. The decision to buy life insurance stems from one desire. The parties can share a number of different aspects of the policy such as responsibility for premium payments the death benefit payouts and dividends.

To provide a financial cushion for certain people. Split dollar life insurance policies are one of the best ways to insure executives and key people to your company. This is a one year term policy that can be placed on anyones life.

Specifically the parties join together to purchase an insurance policy on the life of the employee and agree in writing to split the cost of the insurance premiums as well as the policys death proceeds cash value and other benefits. This guide explains how split dollar policies works the best companies and more.

Metlife Weighs Split Of Retail Business The New York Times

Metlife Weighs Split Of Retail Business The New York Times

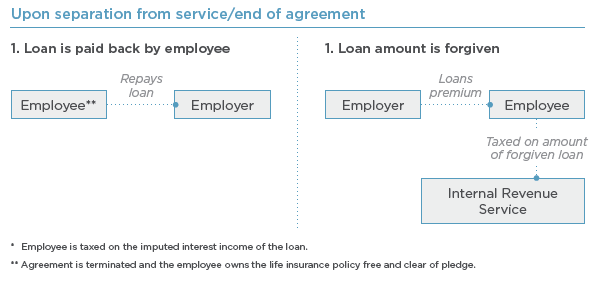

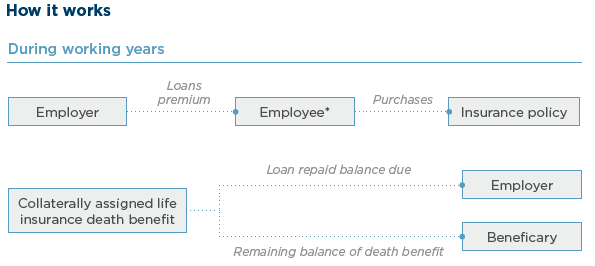

Truenorth Explains The Loan Regime Split Dollar Arrangement

Truenorth Explains The Loan Regime Split Dollar Arrangement

Aviva To Split Life General Insurance Lay Off 6 Of Workforce

Aviva To Split Life General Insurance Lay Off 6 Of Workforce

Split Dollar Life Insurance Split Dollar Insurance

Split Dollar Life Insurance Split Dollar Insurance

Split Dollar Benefits For S Corporations Law Offices Of Dupont

Split Dollar Benefits For S Corporations Law Offices Of Dupont

A Little Known Deferred Compensation Plan That Allows For Tax

A Little Known Deferred Compensation Plan That Allows For Tax

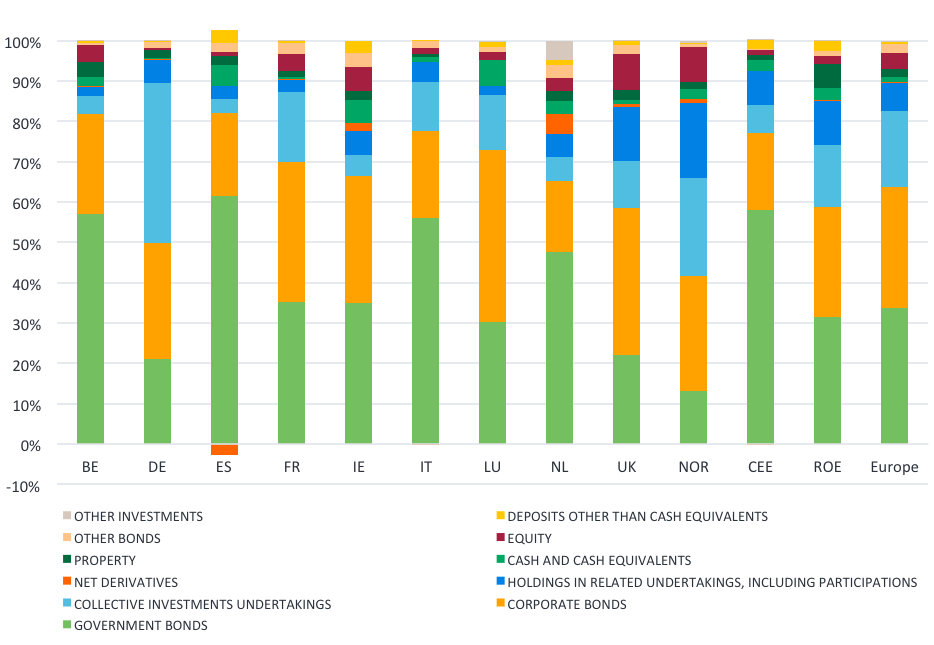

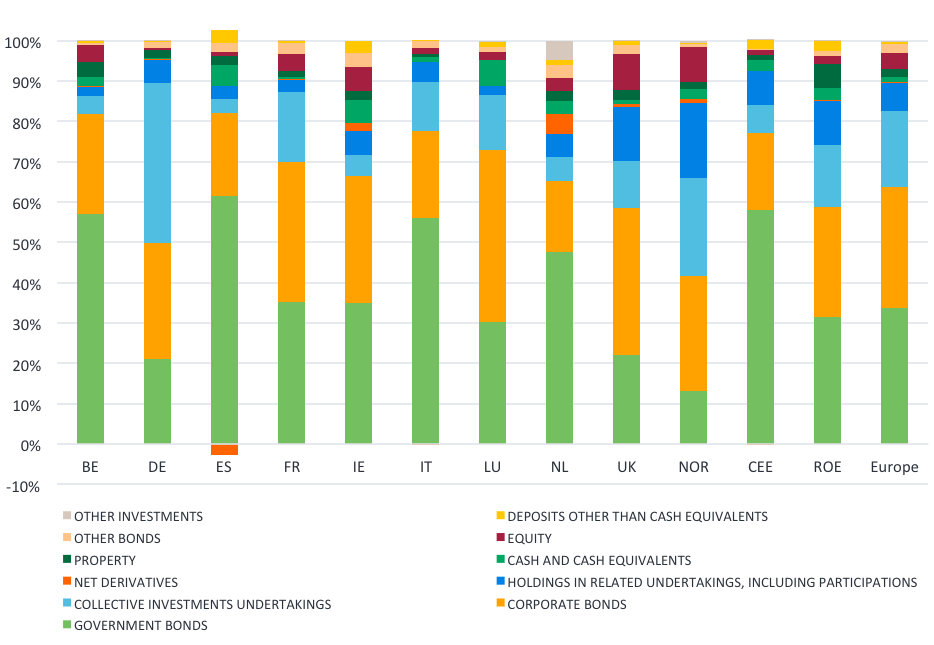

Analysis Of Eea Life Insurance Market 2018 Sfcr Qrt Data

Analysis Of Eea Life Insurance Market 2018 Sfcr Qrt Data

Split Dollar Life Insurance Webinar Youtube

Split Dollar Life Insurance Webinar Youtube

Truenorth Explains The Loan Regime Split Dollar Arrangement

Truenorth Explains The Loan Regime Split Dollar Arrangement

Creative Uses Of Life Insurance Split Beneficiary Planning Ilscorp

Creative Uses Of Life Insurance Split Beneficiary Planning Ilscorp

What Is A Split Dollar Life Insurance Policy The Complete Guide

What Is A Split Dollar Life Insurance Policy The Complete Guide

Split Dollar Life Insurance Arrangements For Small Businesses And

Split Dollar Life Insurance Arrangements For Small Businesses And

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Why Owners Should Have A Split Dollar Insurance Policy Humi Blog

Why Owners Should Have A Split Dollar Insurance Policy Humi Blog

How Do We Split Life Insurance In Divorce Bankrate Com

How Do We Split Life Insurance In Divorce Bankrate Com

Fillable Online Aig Relevant Life Insurance Split Trust

Fillable Online Aig Relevant Life Insurance Split Trust

Split Dollar Life Insurance Accounting

Split Dollar Life Insurance Accounting

Split Dollar Loans With Permanent Life Insurance Ppt Download

Split Dollar Loans With Permanent Life Insurance Ppt Download

What Is Split Dollar Life Insurance Cu Management

What Is Split Dollar Life Insurance Cu Management

Davidson Wealth Management Davidson Nc

Davidson Wealth Management Davidson Nc

The Role Of Life Insurance In Business Succession Planning Ppt

The Role Of Life Insurance In Business Succession Planning Ppt

Prudential Announces Split Of Global Businesses World Finance

Prudential Announces Split Of Global Businesses World Finance

Komentar

Posting Komentar