Taxes On Life Insurance Proceeds

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. If you buy a life insurance policy on your own or through your employer your premiums are probably paid with after tax dollars.

![]() Life Insurance Beneficiary What Are The Probate And Tax

Life Insurance Beneficiary What Are The Probate And Tax

Life insurance can give your loved ones financial security should you die.

Taxes on life insurance proceeds. The taxation of life insurance proceeds depends on several factors including whether you paid your insurance premiums with pre or after tax dollars. Life insurance proceeds are typically not taxable as income but there are several cases in which a life insurance death benefit or policy benefits would be taxed. Most of the time proceeds arent taxable.

But there are certain. See topic 403 for more information about interest. However any interest you receive is taxable and you should report it as interest received.

Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. Taxes on life insurance proceeds if you are looking for a way to get quotes on different types of insurance then our insurance quotes service can get you the best offers available. If you have taken out life insurance to provide a lump sum or regular income to your loved ones when you die there is usually no income or capital gains tax to pay on the proceeds of the policy.

This tax free exclusion also. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. Taxes on life insurance proceeds if you are looking for low cost insurance then our online insurance quotes service will help you find a provider that works for you.

In most cases life insurance proceeds are not taxable so your beneficiaries should get the full amount available under. Learn whether youll have to pay taxes on life insurance. However if the total value of your estate is more than 325000 inheritance tax iht will be deducted from your insurance pay out at a rate 40.

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

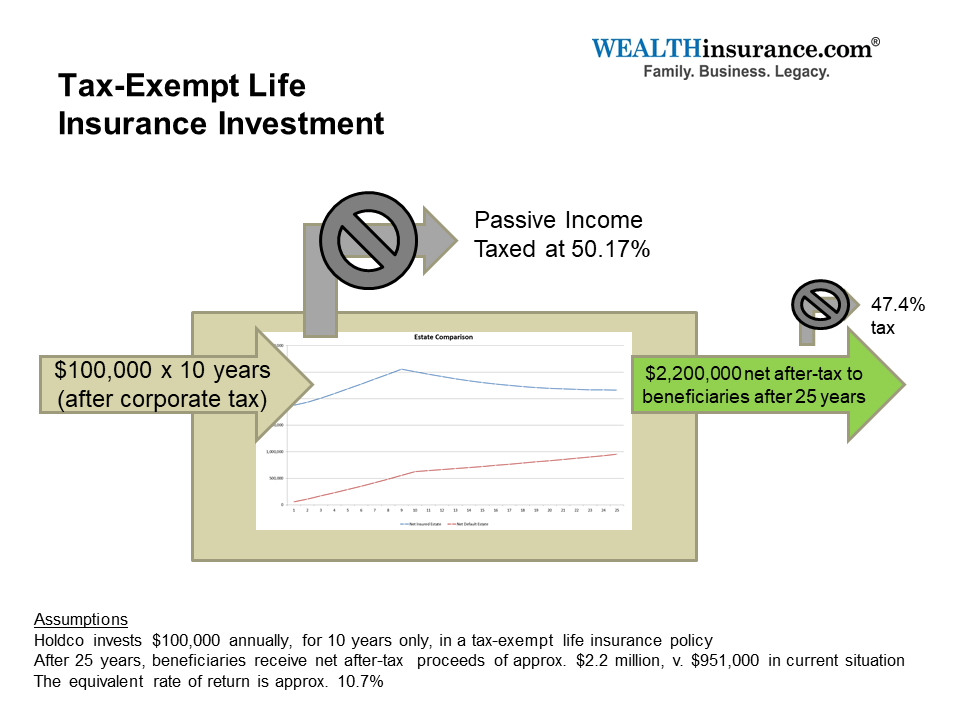

Tax Exempt Life Insurance Investment

Tax Exempt Life Insurance Investment

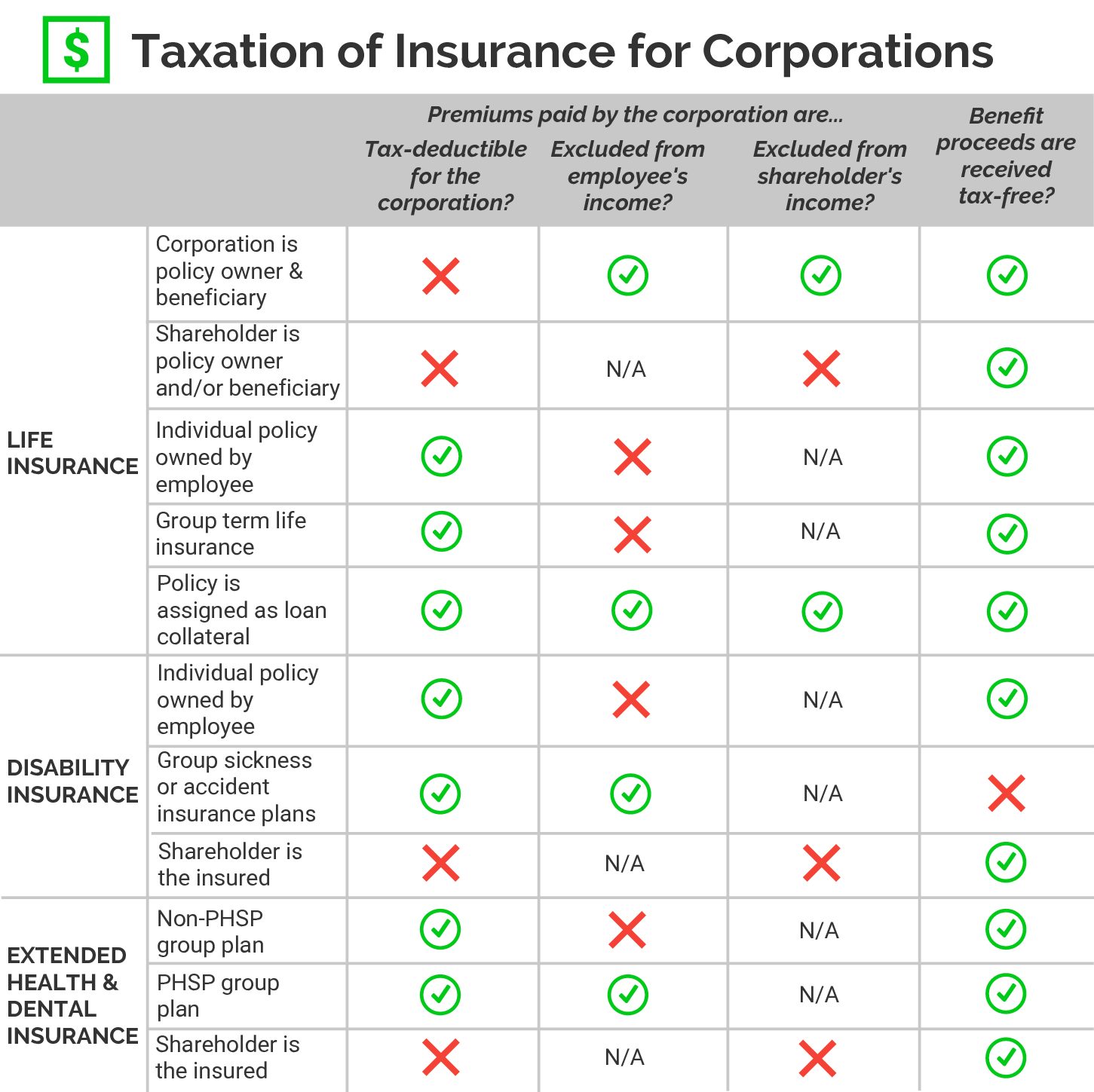

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Sec 194da Calculate Taxable Returns From Life Insurance

Sec 194da Calculate Taxable Returns From Life Insurance

Tax Rules For Life Insurance Lovetoknow

Tax Rules For Life Insurance Lovetoknow

Insurance Policies Are Tax Free Thetaxtalk Not All Proceeds From

Insurance Policies Are Tax Free Thetaxtalk Not All Proceeds From

Whole Life Insurance Cash Value Chart

Life Insurance Avoiding Taxes On The Proceeds

Life Insurance Avoiding Taxes On The Proceeds

Life Insurance To Replace Gift Women In Distress

Life Insurance To Replace Gift Women In Distress

Capital Dividend Account Gordon Malic

Capital Dividend Account Gordon Malic

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

Debunking The Myth That Life Insurance Proceeds Are Always Tax

Debunking The Myth That Life Insurance Proceeds Are Always Tax

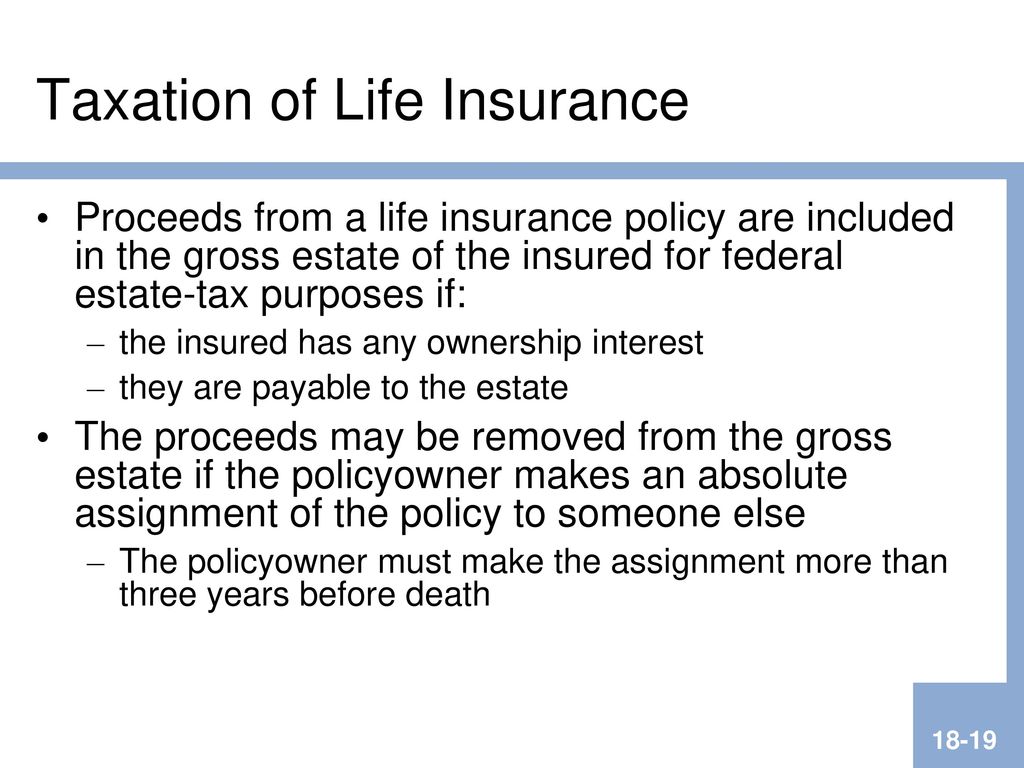

Chapter 13 18 Life Insurance Purchase Decisions Ppt Download

Chapter 13 18 Life Insurance Purchase Decisions Ppt Download

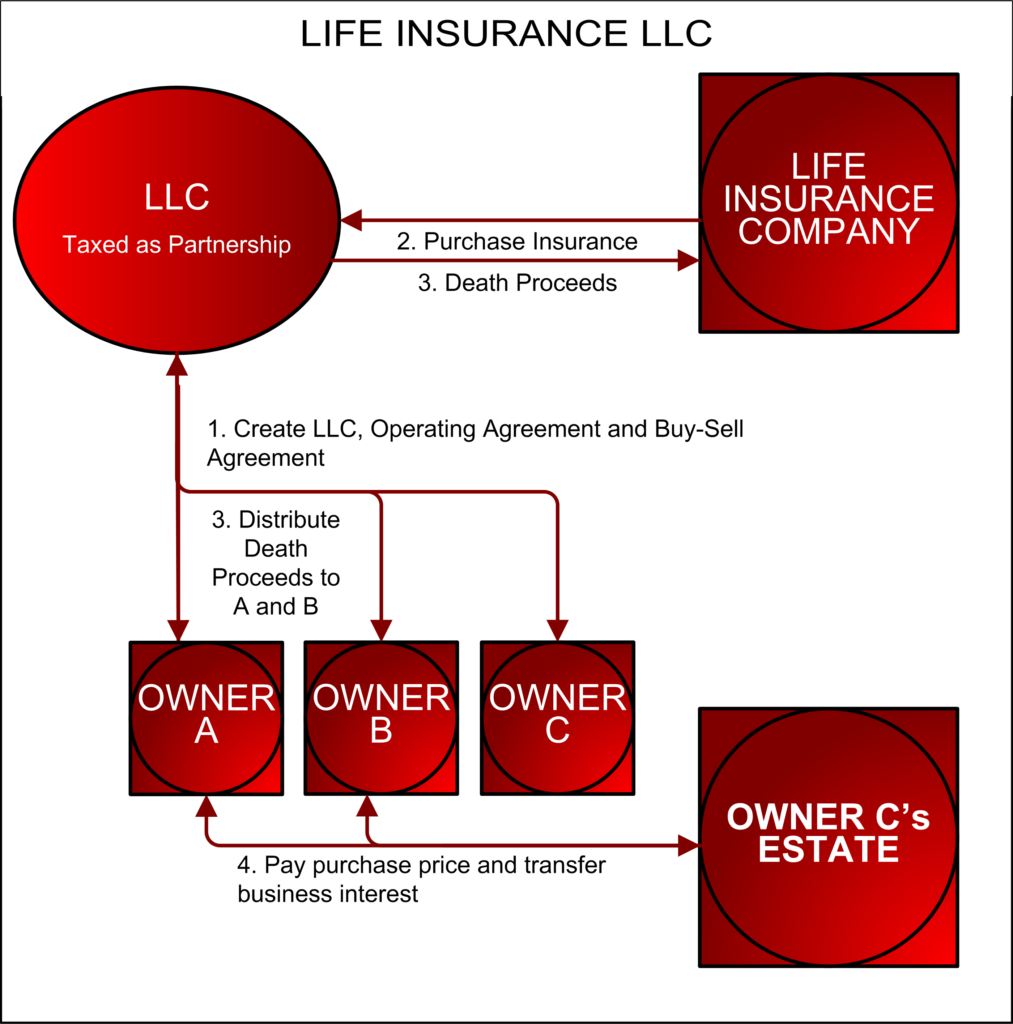

The Life Insurance Llc A Potential Solution To The Buy Sell Tax

The Life Insurance Llc A Potential Solution To The Buy Sell Tax

/hispanic-saleswoman-talking-to-clients-in-living-room-580504711-5995f8d722fa3a001149763c.jpg) Life Insurance Death Benefits Estate Tax

Life Insurance Death Benefits Estate Tax

Can The Irs Go After An Insurance Policy With A Beneficiary After

Can The Irs Go After An Insurance Policy With A Beneficiary After

How To Avoid The Federal Estate Tax When Collecting Life Insurance

How To Avoid The Federal Estate Tax When Collecting Life Insurance

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Who Might Purchase Whole Of Life Insurance

Who Might Purchase Whole Of Life Insurance

Corporate Life Insurance Opportunities To Die For

Corporate Life Insurance Opportunities To Die For

Introduction To Income Taxation Gross Income General Rule

Introduction To Income Taxation Gross Income General Rule

Solved All Of The Following Statements About The Taxation

Solved All Of The Following Statements About The Taxation

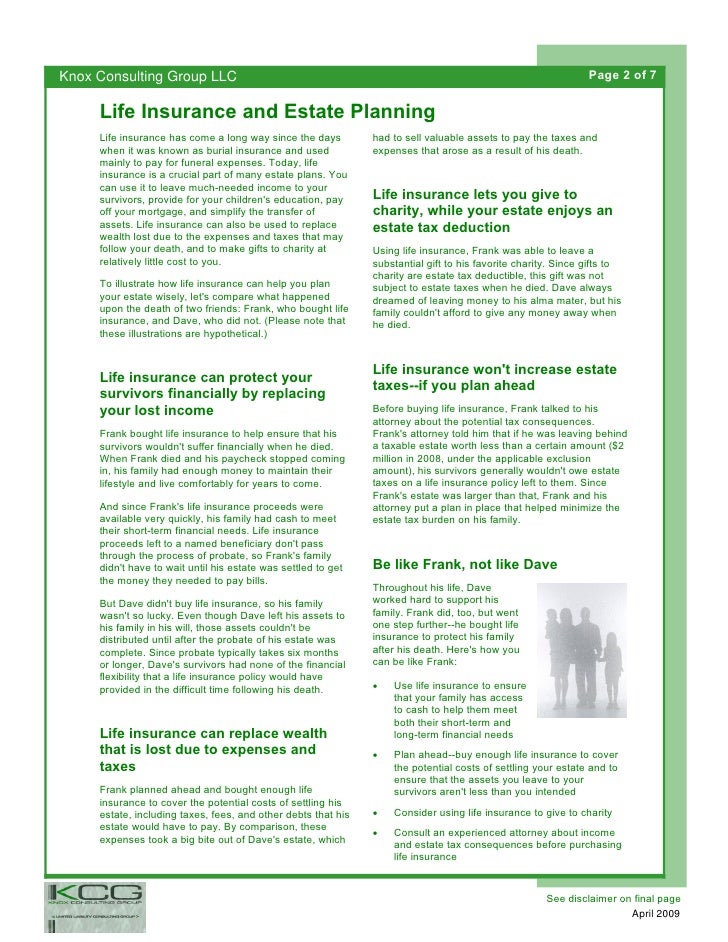

Life Insurance And Estate Tax Presentation

Life Insurance And Estate Tax Presentation

Are Insurance Proceeds Taxable Income A Look At Tax Rules On

Are Insurance Proceeds Taxable Income A Look At Tax Rules On

Komentar

Posting Komentar