Tax Free Life Insurance Investment

Tax exempt life insurance investment. Some life insurance products are designed to be an investment as well as a form of protection.

Most people know what life insurance is but dont know everything it can do.

Tax free life insurance investment. The top 9 tax free investments everybody should consider. Our clients buy insurance as an alternative investment to low risk low yield highly taxed investments like bonds gics etc. Paying taxes is no fun.

Life insurance protects your family from your financial debts and obligations after you die by providing a death benefit but it also may be used for business purposes to compensate a company for the loss of a key person in the company. These are called endowments or investment plans if you pay regular premiums or investment bonds or single premium bonds if you pay in one or more lump sums. When it comes to considering life insurance as an investment youve probably heard the adage buy term and invest the difference this advice is based on the idea that term life insurance.

Fortunately there are many tax free investment options available each with their own unique set of benefits. The tax treatment of a life policy is. Louisiana says of life insurance to protect investments.

Proper tax planning should do two things. Nerdwallet is a free tool to. Reduce your taxes while you are alive as well as after you die.

Use life insurance for a tax free estate plan. How to get tax free retirement income with life insurance life insurance can be used to secure tax free income both in the accumulation phase and the distribution phase. Using tax advantages of life insurance in your financial plan.

Permanent life insurance gives you the potential to cover these two bases at once you. Life insurance proceeds may be tax free depending on what proceeds you or your beneficiaries receive. At death the named beneficiary receives the leveraged or larger amount.

So by stuffing an otherwise taxable investment inside a tax free life insurance policy investors can reap the compounded gains of that investment and the death benefit all tax free. The dividends received on eligible life insurance policies are also tax free and do not.

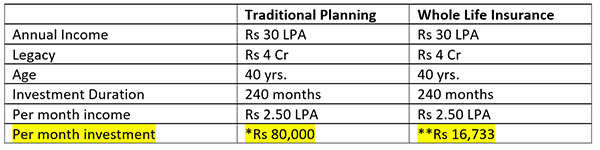

Wealthprotectionplus Com Whole Life Wealthprotectionplus Com

Wealthprotectionplus Com Whole Life Wealthprotectionplus Com

Your Life Insurance Policy Might Be Your Best Investment

Your Life Insurance Policy Might Be Your Best Investment

5 Ways To Plan A Tax Free Life With Life Insurance Plans And Other

5 Ways To Plan A Tax Free Life With Life Insurance Plans And Other

Beyond The Roth Ira Life Insurance For Tax Free Retirement Income

Beyond The Roth Ira Life Insurance For Tax Free Retirement Income

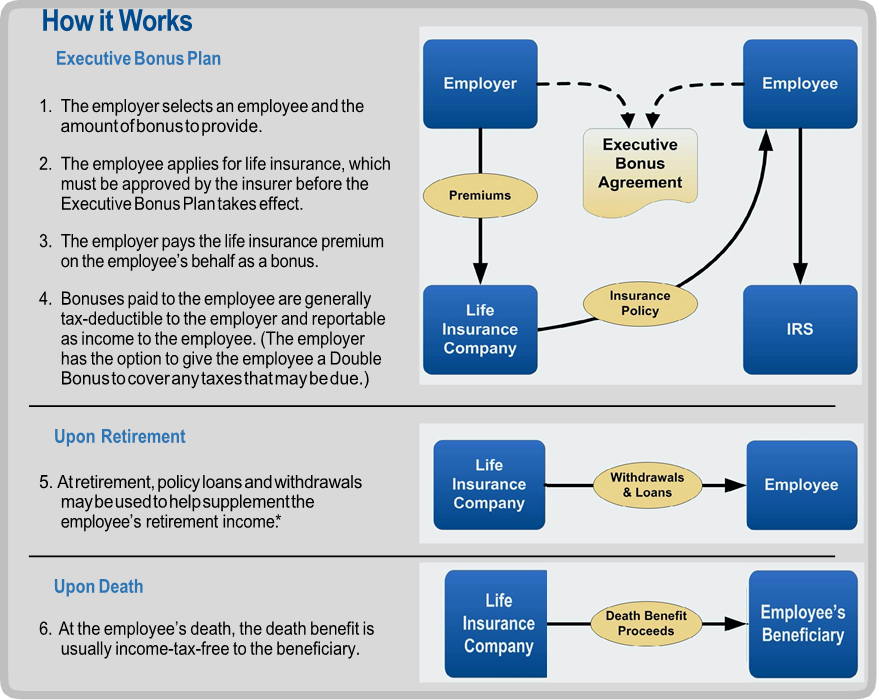

Executive Compensation Bonus Plan Gulfport Ms Mayfield

Executive Compensation Bonus Plan Gulfport Ms Mayfield

Tax Exempt Life Insurance Larry Kleinmintz Wealthstrategist

Tax Exempt Life Insurance Larry Kleinmintz Wealthstrategist

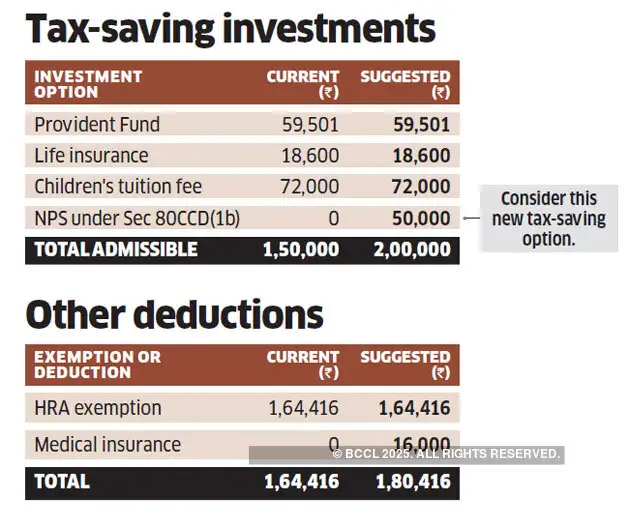

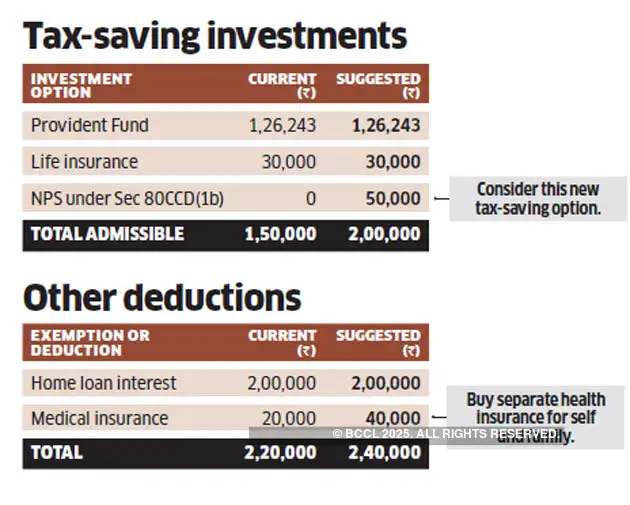

Tax Optimiser How Shah Can Cut Tax By Rs 42 000 Via Tax Free

Tax Optimiser How Shah Can Cut Tax By Rs 42 000 Via Tax Free

Whole Life Insurance As An Investment Better Returns Than The Bank

Whole Life Insurance As An Investment Better Returns Than The Bank

Effective Ppli Real Estate Structures 2 Blog Michael Malloy

Effective Ppli Real Estate Structures 2 Blog Michael Malloy

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

Cash And Cash Equivalents Chapter 1 Tools Techniques Of

Building A Financial Foundation How Taxes Effect Your Wealth

Building A Financial Foundation How Taxes Effect Your Wealth

Health Insurance Tax Deductions Save Money Do You Qualify

Health Insurance Tax Deductions Save Money Do You Qualify

Cash Value Life Insurance In Retirement Planning Insurance Fiduciary

Cash Value Life Insurance In Retirement Planning Insurance Fiduciary

Tax Treatment Taxability Of Various Financial Investments

Tax Treatment Taxability Of Various Financial Investments

Private Placement Life Insurance Wisdom Capital

Private Placement Life Insurance Wisdom Capital

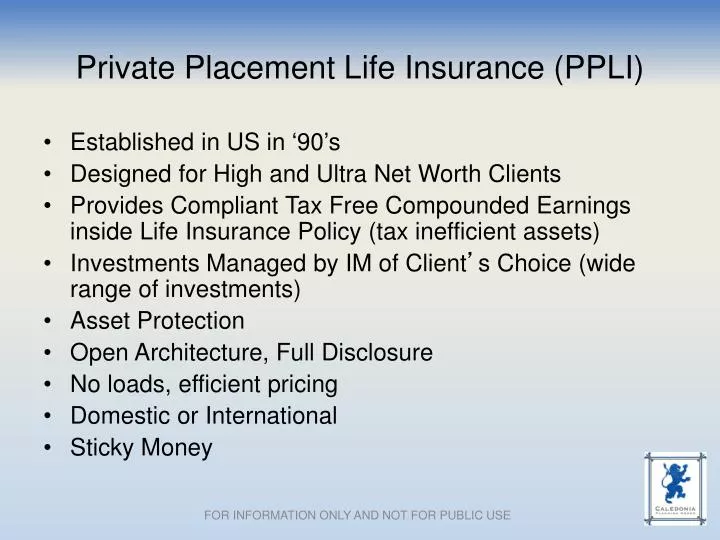

Ppt Private Placement Life Insurance Ppli Powerpoint

Ppt Private Placement Life Insurance Ppli Powerpoint

Leave A Tax Free Legacy For Your Children With Whole Life

Leave A Tax Free Legacy For Your Children With Whole Life

What Is Vul Insurance And Should You Get One Moneymax Ph

What Is Vul Insurance And Should You Get One Moneymax Ph

Tax Free Life Insurance Offers Different Investment Options

Tax Free Life Insurance Offers Different Investment Options

Pin By Jitendrasonawane On Lic008 Life Cover Investing Marketing

Pin By Jitendrasonawane On Lic008 Life Cover Investing Marketing

What Is Guaranteed Universal Life Insurance And How Does It Work

What Is Guaranteed Universal Life Insurance And How Does It Work

Komentar

Posting Komentar